6 Simple Techniques For Insurance Agency In Jefferson Ga

Table of ContentsThe Ultimate Guide To Insurance Agency In Jefferson GaThe Life Insurance Agent In Jefferson Ga StatementsAbout Insurance Agent In Jefferson GaWhat Does Auto Insurance Agent In Jefferson Ga Do?

According to the Insurance Details Institute, the typical yearly cost for a vehicle insurance coverage in the United States in 2016 was $935. 80. Generally, a solitary head-on collision can cost hundreds of dollars in losses, so having a policy will cost less than paying for the crash. Insurance policy likewise assists you prevent the decline of your automobile. The insurance coverage safeguards you and assists you with insurance claims that others make against you in mishaps. The NCB might be provided as a discount on the premium, making cars and truck insurance coverage much more budget friendly (Insurance Agent in Jefferson GA).

A number of factors influence the expenses: Age of the car: Oftentimes, an older automobile costs much less to guarantee contrasted to a more recent one. New vehicles have a higher market price, so they cost even more to repair or change. Parts are less complicated to find for older vehicles if repair work are required. Make and model of automobile: Some lorries cost more to insure than others.

Danger of burglary. Certain vehicles regularly make the often taken listings, so you might need to pay a greater costs if you possess one of these. When it pertains to vehicle insurance, the three primary sorts of plans are liability, crash, and extensive. Mandatory liability coverage pays for damages to another vehicle driver's vehicle.

Get This Report about Business Insurance Agent In Jefferson Ga

Some states call for vehicle drivers to bring this coverage (https://www.slideshare.net/jonportillo30549). Underinsured motorist. Comparable to uninsured insurance coverage, this policy covers damages or injuries you suffer from a driver who does not bring adequate insurance coverage. Motorcycle insurance coverage: This is a plan particularly for motorbikes because automobile insurance policy doesn't cover motorcycle accidents. The benefits of automobile insurance much outweigh the risks as you could finish up paying countless dollars out-of-pocket for an accident you trigger.

It's usually far better to have even more protection than insufficient.

The Social Safety and Supplemental Security Revenue handicap programs are the largest of numerous Federal programs that give help to individuals with handicaps (Business Insurance Agent in Jefferson GA). While these 2 programs are various in numerous ways, both are administered by the Social Safety And Security Administration and just people who have a special needs and satisfy clinical requirements may receive advantages under either program

Utilize the Advantages Eligibility Screening Tool to learn which programs might be able to pay you benefits. If your application has lately been rejected, the Web Allure is a beginning point to ask for a review of our decision concerning your qualification for impairment advantages. If your application is denied for: Medical reasons, you can finish and send the Charm Demand and Charm Special Needs Record online. A succeeding analysis of employees' compensation claims and the degree to which absenteeism, spirits and employing great employees were problems at these firms reveals the favorable impacts of providing health and wellness insurance. When compared to services that did not offer medical insurance, it appears that supplying FOCUS caused enhancements in the capability to employ great workers, reductions in the variety of employees' compensation insurance claims and decreases in the extent to which absenteeism and efficiency were troubles for FOCUS companies.

Not known Facts About Auto Insurance Agent In Jefferson Ga

Six records have been released, consisting of "Care Without Insurance Coverage: Inadequate, Far Too Late," which discovers that working-age Americans without health insurance coverage are more probable to get as well little clinical treatment and obtain it far too late, be sicker and die faster and receive poorer treatment when they are in the medical facility, also for intense scenarios like an automobile collision.

The study writers likewise note that increasing protection would likely result in a boost in genuine source expense (no matter that pays), because the uninsured receive regarding fifty percent as much medical care as the independently insured. Health Affairs released the research online: "Just How Much Treatment Do the Uninsured Use, and That Pays For It? - Insurance Agent in Jefferson GA."

The duty of giving insurance policy for employees can be a daunting and occasionally pricey task and many local business assume they can't afford it. Yet are advantages for employees needed? What benefits or insurance policy do you legitimately need to supply? What is the distinction in between "Employee Perks" and "Worker Insurance"? Let's dive in.

Some Known Details About Insurance Agency In Jefferson Ga

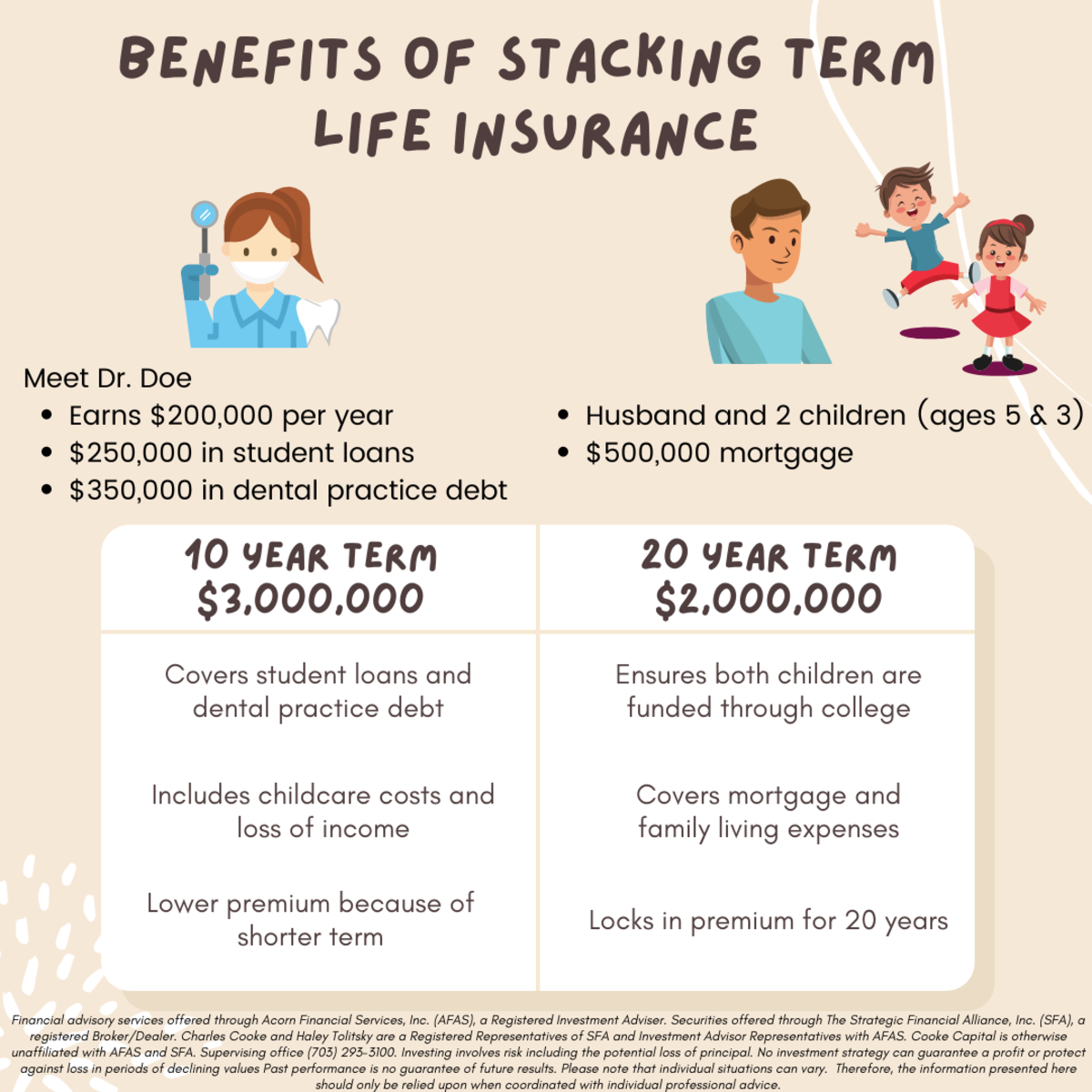

Staff member benefits typically begin with health insurance policy and group term life insurance coverage. As component of the health insurance coverage plan, a company may decide to provide both vision and dental insurance.

With the rising fad in the price of medical insurance, it is reasonable to ask staff members to pay a portion of the coverage. A lot of businesses do position the bulk of the expense on the employee when they supply access to health and wellness insurance. A retirement (such as a 401k, straightforward plan, SEP) is usually provided as a staff member benefit as well - https://www.4shared.com/u/IaFm96Zy/jonportillo30549.html.